Managing Your Personal Finances

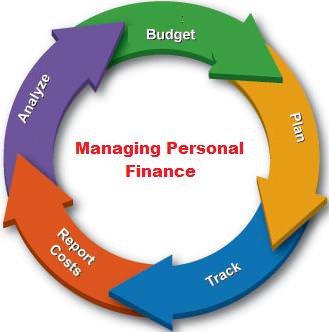

In these uncertain times, it is increasingly important to understand your personal finances situation. Budgeting is essential for the average individual and increased awareness of savings versus spending enters conversations on a daily basis. If you are trying to take control of your personal finances situation, there are many great pieces of advice that can help. In this article, we will explore a few of the basics.

In these uncertain times, it is increasingly important to understand your personal finances situation. Budgeting is essential for the average individual and increased awareness of savings versus spending enters conversations on a daily basis. If you are trying to take control of your personal finances situation, there are many great pieces of advice that can help. In this article, we will explore a few of the basics.

Make more than you spend. This concept is simple; in order to get ahead with your savings and stay out of debt, you should always bring home more money than you put out. Following this concept will require you to make some simple lifestyle changes, but it is well worth the effort in the end.

Create a budget and stick to it. One great way to manage your money and spend less than you earn is to create a budget. Write down all of your income sources and all of your expenditures. Start by highlighting the essential expenses in your life, such as your mortgage, utilities and food expenses. Next, take some time to review your frivolous spending habits, such as movie nights and dining out. This will help you to understand the areas in which you can cut back, and it allows you to work toward saving more.

After you have a budget in place, it is time to start tackling your debt. Take a look at your credit card debt first and work toward paying it off. Make a goal of using your savings to tackle your credit cards one by one. Start by sending the minimum amount to all of your creditors, except for the creditor that you owe the lowest amount to. For that creditor, send as much as you can until you have paid the bill off. Paying off that one account will give you the confidence that you need to move on to your next account. This is a great way to get out of debt but remember to not continue to use your credit card accounts or you will only increase your debt.

When you have taken care of the debt that you owe, it is time to start saving. You should save for two purposes – to create an emergency fund and to prepare for retirement. Your emergency fund should offer you enough money to fully support you for a six month period of time if you should lose your income. Your retirement account should contain enough to support your lifestyle for several years after you stop working. When it comes time to start saving, it is a good idea to discuss your needs with a personal finances adviser so they can help you to devise a plan that works.

The time to start managing your personal finances situation is now. Do it right and your money will serve you well for many years to come. Follow the advice from this article to get yourself started. The reward will be a life that is free from personal finances stress and hardships.