Personal Finance Savings with a New car

In today’s economy it’s crucial to spend carefully in order to maintain your personal financial health. Use the tips below to personal finance savings with a used or a new car.

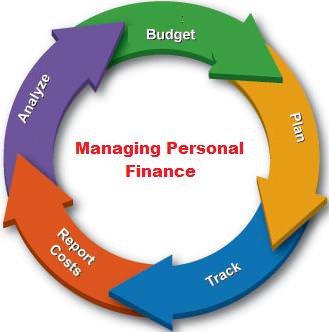

Establish your budget for your vehicle in terms of whether you’ll be paying cash or more likely credit. If you’re choosing to finance your vehicle it’s important to consider financing options available. While used car loans are frequently more expensive than new car loans, including dealer financing of zero percent, the total cost of a used car is less than a new car so that monthly payments will be less.

If you’re buying a used car it’s critical that you make sure you’re getting clean title, especially if you’re dealing with an individual as opposed to a used car dealer. If the person selling the car has to pay off their loan before you can purchase their vehicle there will likely be a time period where you don’t have title to the vehicle and you’ve parted with your money. In these instances it is critical that you protect your financial investment by calling the company that currently holds the lien on the vehicle and asking what advice they can provide on conducting such a transaction.

If you’re buying a used vehicle check the current value of similar vehicles as well as reports indicating accident history for the vehicle. You’ll also want to have a car mechanic look at the vehicle. Ask to see proof of insurance and registration for the person you’re purchasing the vehicle from.

In terms of value, the price of used cars is higher in a bad economy because more people are buying used cars. You’ll want to make sure that you’re not able to purchase a smaller or less expensive model but a newer vehicle with dealer incentives such as extended warranty coverage and less expensive loans. You’ll also want to use information from your mechanic about likely repairs that will be needed and work them into your overall cost.

New Car Insurance

Car insurance coverage is frequently less expensive on used rather than new car but this coverage depends on the vehicle you’re purchasing.

Be aware that if you’re purchasing a vehicle with a car loan you’ll likely be obliged to carry collisions and comprehensive insurance coverage to make sure that the person lending you money can recoup the costs of their investment if something happens to the vehicle.

Although car loans for used cars usually charge higher interest rates than those for new vehicles, personal loans usually charge more in interest than any type of car loan. This is because a personal loan is uncollateralized meaning that the car is not repossessed if you miss payments but rather other avenues are sought by the company lending money to get their payments you owe. One of the benefits of using a personal loan rather than a car loan is that you usually are not obligated to carry collision and comprehensive coverage because the car is not collateral for the loan.

Purchasing a new or used vehicle is a big decision affecting your monthly expenses and your ability to have a usable vehicle. Use the tips above to begin considering whether you should buy a used or a new car.