Get Control Of Your Personal Finances

With the cost of living going up, it is becoming difficult to get control of your personal finances. Although it is difficult, it is not impossible. Regardless of how much money you make, if you manage you money well, you can be ensured that you will have enough to live on. Read this article for control of your personal finances on how you can start in planning for you future.

With the cost of living going up, it is becoming difficult to get control of your personal finances. Although it is difficult, it is not impossible. Regardless of how much money you make, if you manage you money well, you can be ensured that you will have enough to live on. Read this article for control of your personal finances on how you can start in planning for you future.

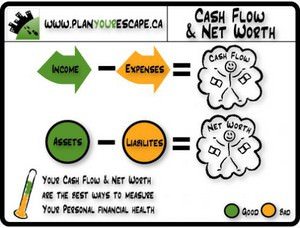

It sounds pretty basic to follow a budget, but it is important to realize that your budget is the basic tool to get control of your personal finances. The most important element to good financial planning is a realistic budget. Basically, you write down how much income you take in every month and how much money you spend every month in different categories of expenses. You will have fixed expenses that are the most important, such as your house and car payments, utilities, food and insurance. Then you have other expense areas like how much you spend for clothing, transportation, entertainment and other things. A budget gives you a clear picture of how you can adjust your spending so that it is not above the income that you bring in.

When you need to go shopping, have a list with you of the things that you have to get, and do not deviate from it. Once you enter a store, it is easy to fall prey to advertisements of big sales. If the sale is for something on your list, that is great. However, if the sale is for something that you do not need, walk past it. Avoid any impulse buying, no matter how good the sale is.

Set some goals on what you want to accomplish in your financial plan. Do you have a big ticket expense for which you need to save up? Your budget is where you can make adjustments to save for those goals.

Be sure that your financial plan includes saving for an emergency fund. This money is very important as a safety net for times when you have unexpected financial needs, like a big medical expense. This money will also come in handy if you ever lose your employment. Aim at building up a fund that can cover at least six months of your monthly expenses. It is not that hard to do if you make cut backs in your discretionary expense areas and start saving now.

If you have a lot of outstanding debt, make an effort to pay off those debts. High interest rates can really make your debt bigger month after month. If necessary, work with a reputable debt consolidating service to create a plan where you can pay off your debt by a certain period of time. Make that a priority in your budget.

It is important to set up a solid retirement account. If your employer has a 401K plan with matching, take full advantage of it. If you are self-employed, contact a reputable financial investment institution and open up a retirement account. Make an appointment with a financial adviser and take your budget with you. The adviser can help you with financial planning and recommend how you can save for your retirement, given your current financial situation.

Money is limited, and creating a sound financial plan requires some adjustments in your lifestyle. However, when you consider the financial security that you will achieve by following your personal finances plan, it is worth the effort.