Importance of Managing Personal Finances

Are you able to keep your personal finances under control? If you need some help with your personal finances, you should take a few minutes to read this article.

Are you able to keep your personal finances under control? If you need some help with your personal finances, you should take a few minutes to read this article.

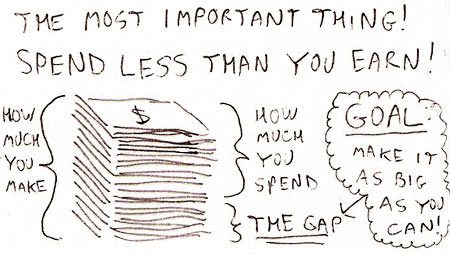

Establish a realistic budget and stick to it as best as you can. Take into consideration your income and the expenses you cannot reduce. You should keep track of everything you earn and spend by keeping a journal, going over your bank statements or using online banking. At the beginning of each month, put some money aside to cover your utilities and try saving as much money as possible to face emergencies. Adapt your budget to your income: you might have to put less money aside or reduce certain expenses if you earn less money than usual.

Pay back your debt as quickly as possible. You should stop using your credit card and avoid borrowing money from financial institutions. Put money aside for emergencies or borrow some cash from your friends and relatives. If you are already in debt, you should call your creditors and agree on a payment plan. If possible, merge all your debts into one account so you only have one payment to make. If you cannot do this, start by paying back your most outstanding debt so that the interests do not add up. Get help from a professional if you need to: you might be able to negotiate a better payment plan if you have someone to help you. Once you are debt free, make an effort to stay away from credit cards, payday loans and other financial products that are not easy to manage.

Make plans for the future and put some money aside to personal finances your projects. The easiest way to finance your future is to open a savings account with a good interest rate, but do not hesitate to diversify your investments in function of what you want to accomplish. If you are thinking about your retirement, open an IRA and do not assume you will not have to worry about your retirement until you are older. You could send your children to college thanks to a 529 savings plan or finance your own small business by investing on the stock market. It is important that you do some research first and select safe investments that will pay off on the long term.

Be smart and responsible about your personal finances. In a lot of cases, you can save money by taking the time to compare prices, making sacrifices or working a little more. Do not choose the easy solution: for instance, you can save by going to the grocery store, buying some food and cooking it instead of going out to a restaurant every day. You can also save by taking the time to compare different options before you purchase an insurance. Get your family to help you with these things so that financial responsibility is shared by everyone in your household.

Make a few changes to your lifestyle and do your best to become more responsible about spending and saving. Keep in mind that managing your personal finances more efficiently will help you achieve more things in the future.