Protecting Your Finances in the Event of a Job Loss

Job loss creates a variety of emotions including stress and panic about your personal finances. Use the suggestions below to protect your finances in the event of a job loss.

Job loss creates a variety of emotions including stress and panic about your personal finances. Use the suggestions below to protect your finances in the event of a job loss.

Listen carefully to the terms of your severance and take advantage of assistance from human resources in establishing what your assets are as you leave the company. You’ll likely be notified of the terms of your severance in terms of pay for a specific amount of time and health insurance coverage benefits, if you have any for a similar period of time. If you’ve accumulated retirement money or you have purchased term insurance through your company, consider these assets as well when you’re going through your paperwork. Similarly, if you have purchased company stock consider how much stock you’ve accumulated.

Write down when you’ll have to begin replacing assets that will expire from the company including paycheck, health benefits, retirement contribution, life insurance coverage and stock if any. Once you have that list you should have a list of dates when you’re going to start experiencing the crunch from your unemployed status.

Register for unemployment benefits because they take some time to process. While rules differ according to states, most states allow you to register for such benefits online. It’s likely you won’t be collecting unemployment during the time you’re collecting severance although it sometimes depends how the severance is paid out, as a lump sum or as a paycheck over a period of time. If you have a question about filing you should speak with a representative before you file for unemployment benefits.

If you can, pre-pay mortgage or rent for three months in advance. Pre-paying on a mortgage offers the added benefit of a small amount of interest savings and for rent there will be an avoidance of any late fees imposed for late payments. You should make these pre-payments shortly after your termination before panic or mild depression set in about your situation which can negatively influence your financial decisions.

Stop all automatic bill paying that pulls money from your checking account to pay your bills if you have it to avoid check-bounce fees as a result of money flow into your checking account. You can still pay your bills online but you should avoid automatic withdrawals.

It is likely that you will be able to find less expensive health insurance on your own rather than continuing the cost of your current insurance under COBRA. During the first 30 days after your severance speak with several insurance agents to get concrete quotes about insurance coverage and costs and write these amounts down so that you’re prepared to decide whether you’re going to choose COBRA or other health insurance when your paperwork arrives.

How To Approach Your Personal Finances

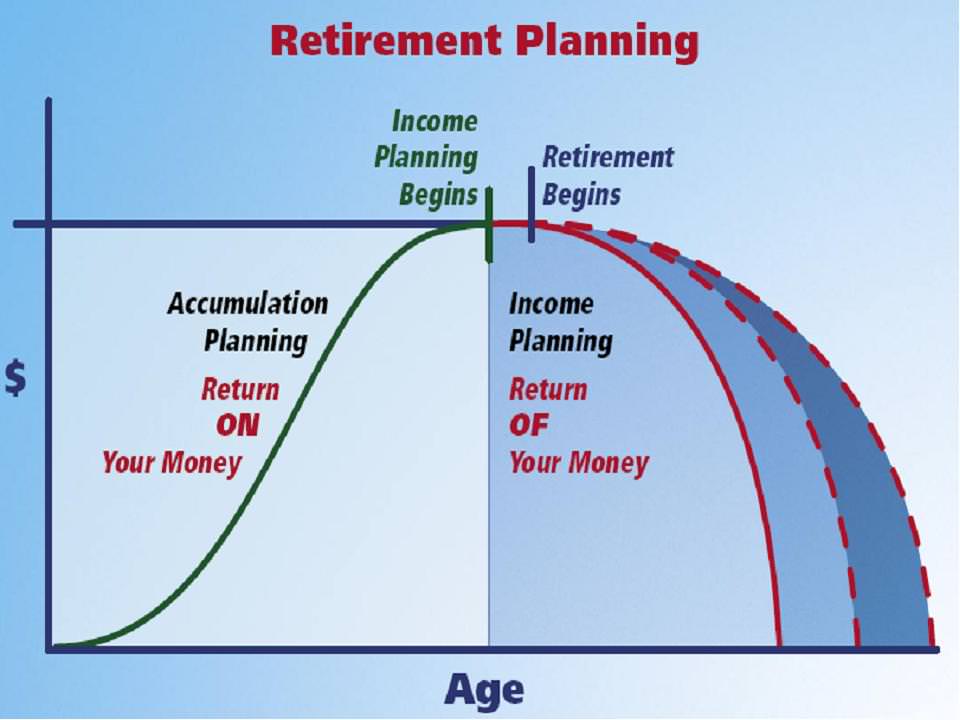

Retirement contribution and life insurance expenses may have to be halted for a certain amount of time if you’re worried about your ability to pay your bills. Term life insurance from your company is usually prohibitively expensive to continue after you’ve separated from employment.

Losing a job is stressful enough without creating unnecessary worry by being disorganized about your approach to your personal finances. Use the tips above to begin organizing your assets if you lose your job.