If you are overwhelmed by debt because of a financial crisis, a health care crisis or any other reason, you might consider Chapter 13 bankruptcy. Chapter 13 bankruptcy is a type of personal bankruptcy that allows you to enter a structured repayment plan in order to pay back your creditors. This type of bankruptcy can help you get out of debt and relieve financial pressure.

Chapter 13 Bankruptcy Eligibility

In order to be eligible for Chapter 13 bankruptcy, you need a steady source of income and enough disposable income to be able to make a monthly payment to your bankruptcy trustee. The amount you will have to pay depends on your income and debt levels.

In order to be eligible for Chapter 13 bankruptcy, you need a steady source of income and enough disposable income to be able to make a monthly payment to your bankruptcy trustee. The amount you will have to pay depends on your income and debt levels.

Most people who have steady jobs qualify for this type of bankruptcy. However, there are limits as to how much debt can be discharged via Chapter 13 bankruptcy. Currently, the limits are $360,475 of unsecured debt and $1,081,400 of secured debt.

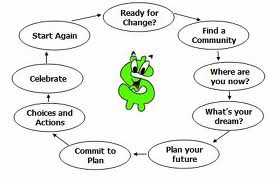

If you are considering Chapter 13 bankruptcy, you need to get credit counseling. Everybody who wants to file for bankruptcy needs to get credit counseling first–you have six months to file for bankruptcy after getting it. More importantly, by getting credit counseling you can find out what all of your options are and decide whether Chapter 13 bankruptcy is really right for you.

Every state offers credit counseling through approved credit counselors except for North Carolina and Alabama. If you live in one of these two states, you have to contact the bankruptcy administrator for your district. Otherwise, contact an approved credit counselor. You can get a list of credit counselors in your state from the U.S. Department of Justice’s website.

When You Need to File Chapter 13 Bankruptcy

When you file for Chapter 13 bankruptcy, you must list all of your debts, both secured and unsecured. The bankruptcy court looks at your debts and your income to determine how much you are able to pay. If you don’t list all your debts or all your income, you could get in legal trouble, so make sure your paperwork is as accurate as possible.

The court prioritizes all your debts in order to figure out how to get them paid. Secured debts are prioritized over unsecured debts, so if you have a lot of debt you will probably have to repay your entire secured debt and a part of your unsecured debt.

Once the court reviews your information, it will approve a repayment plan. You need to pay your bankruptcy trustee on time every month. If you have a financial problem and can’t pay, you need to contact the court immediately. That way, your plan can be modified and you will still be in compliance with it.

While the plan is in effect, your financial freedom is limited. You cannot take out new loans without getting permission from your bankruptcy trustee. This is because the point of Chapter 13 is to give you a chance to start over, so the court doesn’t want you to continue to build debt while repaying your old debts. If you need a loan for a good reason–for example, if your car dies and you need to take out a loan to get another car–you have the right to meet with your bankruptcy trustee to discuss it. If your trustee agrees that you need to take out the loan, he or she will give you a letter of permission stating how much you are allowed to borrow.

After three to five years, you’ll complete your Chapter 13 bankruptcy plan and discharge your remaining debt. By this point, you should be in the habit of paying bills on time. Make sure that you continue in your new habits so that you stay out of financial trouble.