If you have money that you can save for a period of time without touching it and you want an FDIC-insured product, a certificate of deposit may make sense for you. Use the tips below when you’re choosing a Certificate Of Deposit(CD) for your savings.

How Much Do You Put Into a Certificate of Deposit?

Determine how much money you will put into a Certificate Of Deposit and for how long. A certificate of deposit runs for a specific term so that you’ll see CD rates that describe how long your money will be locked into the Certificate Of Deposit ranging from a few months to several years. Choosing how much money to put into your CD means that you believe you won’t need to use that money for the time in which it’s in a Certificate Of Deposit.

Determine how much money you will put into a Certificate Of Deposit and for how long. A certificate of deposit runs for a specific term so that you’ll see CD rates that describe how long your money will be locked into the Certificate Of Deposit ranging from a few months to several years. Choosing how much money to put into your CD means that you believe you won’t need to use that money for the time in which it’s in a Certificate Of Deposit.

Determine whether you are comfortable with dealing with an online bank that has no brick-and-mortar presence. This is an emotionally-based decision because in practice, once your account is set up and you’ve chosen a bank that offers FDIC-insured CDs, using an online versus a brick-and-mortar bank should not impact the safety of your account. It is important to note that setting up your online account will involve sending your personal information from your social security number to an image of your license over the Internet or through the mail which can be a concern if you’re worried about identity theft.

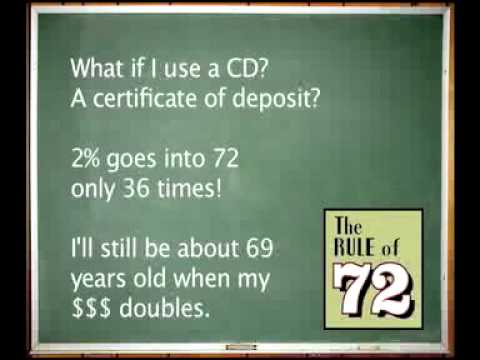

Determine whether the advertised interest rate is available for depositors with your amount of money. Some CD products have a minimum required investment amount in order to get the interest rate advertised. If this is the case then check around to see whether another bank offers a better interest rate for someone who has your amount of money to invest. Don’t assume that a promotional rate means that the bank’s other Certificate Of Deposit rates, those for different lengths of time or those requiring less initial investment are also competitive.

How to Take Money Out of a Certificate of Deposit

Look for promotional Certificate Of Deposit features, such as those that pay higher interest or offer another perk for opening a Certificate Of Deposit. For instance, you can search for no-withdrawal penalty CDs which are periodically offered by some banks in an effort to get you to open a Certificate Of Deposit with them. The reason this is a promotion is because in most instances if you need to take your money out of a Certificate Of Deposit, you’ll be charged a penalty. It is important to remember that CDs typically do not offer the option of a partial withdrawal.

Consider CDs that provide for bump-ups, which means that if during a specific period of time interest rates rise you have the option of getting the higher interest rate. Most CDs that offer the bump-up feature or the best interest rate features such as those occurring within a specific amount of time after you open a Certificate Of Deposit require you to find the better rate, so keep checking out interest rates during that period of time. Make sure that the Certificate Of Deposit period is not extended each time you bump up your interest rate as well as how many times you can bump-up your interest rate.

Having money to invest is a great opportunity for you to earn interest on your money. Use the tips above to determine whether a certificate of deposit should be part of your personal savings strategy.