How to Manage Your Personal Finances Effectively

In order to manage your personal finances effectively, you need to find the methods that are right for you. The right approach will depend on your circumstances. Read this article for suggestions that will help you down the right path.

In order to manage your personal finances effectively, you need to find the methods that are right for you. The right approach will depend on your circumstances. Read this article for suggestions that will help you down the right path.

To manage your personal finances well, you will need to make a financial plan. This includes your financial goals. Think about what you and your family will need financially in the short-term and long-term, and include that in your goal. Then, think about how you will save up for it. You may need to consult with a good financial planner to help you develop a realistic and attainable financial plan. This will provide the framework for how you will manage your money.

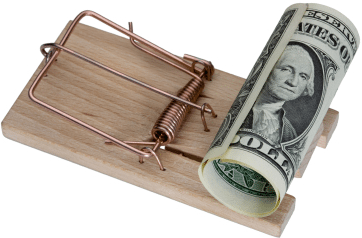

Avoid the temptation of charging or borrowing money to pay for something if you do not have a solid plan on how you will make payments on it. This is exactly why so many people are deep in debt. If you do not have a way to pay for it now, chances are, you will not have a way to pay for it later. So, avoid falling into this trap.

Debt is like quicksand. It is not hard to stay out of it because there is always a way around it. However, once you are in it, you can sink deeper and deeper into it. Do not borrow money if you can avoid it. Only consider borrowing if you have a solid stream of income that can well cover the payments that you have to make, and only if what you want to purchase has long-term benefits for the future of you and your family.

You should be selective in what you spend your hard-earned money on. Review your monthly expenses and see if there are things that you are paying for that are not bringing you enjoyment. Do you have a gym membership that you hardly use? Are you subscribing to magazines that are just piling up on your coffee table? These are types of things that you can remove from your budget if you are not making use of them.

To make sure that you pay recurring bills on time, consider setting up automatic payments for them. Utility bills and mortgages are good candidates for this. When you have bills set up on auto-pay, you will not risk late payments.

Get Your Finances in Order

If you are having difficulties getting your finances in order, there are professionals who can help you get back on track. You do not need to figure this out alone. If you are over your head in credit card debt, a debt consolidator can help you with payment plans. If you have no idea in how to make a financial plan, a certified financial planner can help you develop a sound financial plan customized to your situation that is the roadmap to the financial security of you and your family.

Shaping up your personal finances is the ideal way to make sure that you are making the most of your money. You can have the peace of mind that the financial needs of you and your family will be met. Apply the suggestions from this article, and you will be off to a good start.