If you are trying to manage your personal financial situation, you must create a monthly budget. A budget is the most important tool in determining how much you are bringing in versus how much you are spending each month. Without this information, you are almost certain to overspend and put yourself into a difficult financial situation. Creating a monthly budget is easy when you have the proper tools. This article will provide you with those tools.

How To Create A Sound Monthly Budget

The first item you need to check off your list in order to create a sound monthly budget is understanding how much you are bringing in every month. Consider all of your sources of income including paychecks, child support, investment income and any other means for bringing in money. Make sure to put only your net income into your budget, as you want to be accurate about how much you have to spend. Never include any lines of credit as income even if they are readily available to you at any time.

The first item you need to check off your list in order to create a sound monthly budget is understanding how much you are bringing in every month. Consider all of your sources of income including paychecks, child support, investment income and any other means for bringing in money. Make sure to put only your net income into your budget, as you want to be accurate about how much you have to spend. Never include any lines of credit as income even if they are readily available to you at any time.

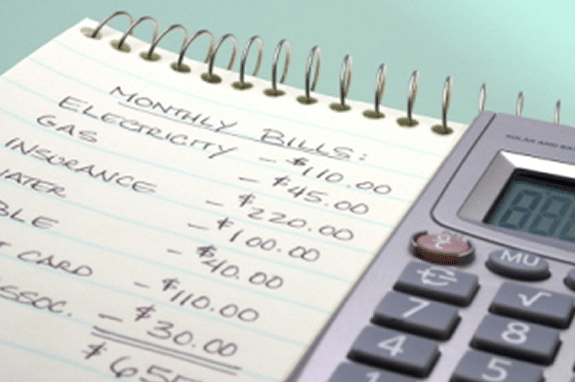

Once you understand your income, it is time to tackle your expenses. Start with the things that you know you must pay every month including your mortgage or rent, utilities, food expenses, gas and transportation and other necessities like child care or medically necessary items. Subtract these items from your monthly income to determine how much discretionary money you have left. This will ensure that you always cover your essentials before spending money on less important things.

The next priority on your budget should be credit card payments and other loans, not including the more important mortgage or car payment that would have been handled in the last step. You must make it a priority to pay at least the minimum on these loans in order to keep your credit in good standings. It is also a good idea to pay more than the minimum with a goal of paying the loans off entirely in as short a period of time as you can. Putting loans and credit cards above eating out, shopping for clothes and other less essential things will improve your credit and get you one step closer to owing less, or eventually owing nothing at all.

Finally, come up with an amount of money you have left after tackling the last two steps and split that up to cover less essential items. This might include dinners out, movies and entertainment, unessential clothing purchases or saving for a vacation. Your goal should be to cover all of these items with cash and still maintain a little bit to put into an emergency savings account. Try not to use your credit cards because that will only cause you to accrue more debt and make it more difficult to truly work within your budget.

Keeping a monthly budget is a critical step toward freedom from financial stress. By following the steps listed above, you can create a sound monthly budget that works for your family. Do this regularly, and you will see the financial benefits.